2024 Benefit Highlights

2024 Open Enrollment closed on Friday, October 27, 2022 at 6:00 pm ET. If you didn’t make any changes to your benefits elections, your 2023 elections rolled over for 2024. If you currently have a flexible spending account and did not re-enroll, you will not have that benefit for 2024.

If you enrolled in the Copay health plan, you cannot participate in the health savings account and will not receive any funding. You may however, use any funds remaining in your HSA for qualified medical expenses.

If you enrolled a spouse in a Company Health Plan, they will be included in a spousal audit for other medical coverage. Please complete the spousal audit form as soon as you receive it. If your spouse’s employer offers insurance and you elect to cover him/her on a Mohawk Health Plan, you will pay an additional $125 per month in medical contributions.

![]()

New for 2024

Cigna Digital ID cards

Cigna is moving health plan members to digital ID cards for health plans and pharmacy. You will not receive a new ID card in the mail. Digital ID cards have become increasingly popular in recent years due to their convenience and security benefits. With a digital ID card, there’s no need to carry around a physical card that can be lost or stolen. Instead, the card can be stored on a smartphone or other mobile device, making it easily accessible at all times. Download your digital ID card at mycigna.com or through the mobile app MyCigna. Still want a printed copy? No worries, you can download and print one from mycigna.com or request one be sent to you via mycigna.com or by calling Cigna Customer Services at 855-566-4295.

Health Saving Account (HSA) moving to Fidelity

Fidelity Investments, our 401(k)-retirement savings partner, will be our new health savings account partner beginning Jan. 1, 2024. Your HSA can help you maximize your retirement savings. And, what’s even better is that you can see your retirement savings and health saving account information in one easy convenient location.

As a current Cigna/HSABank health saving account holder, your account will automatically transition to Fidelity Investments. Please continue to use your HSABank HSA debit card until the transition is complete. Watch for more information as we get closer to 2024.

HSA maximum contribution amount

Employee only: $4,150

Family: $8,300

55+ additional $1,000

Health Plan Changes

- For 2024 the Cigna Local Plus network in northwest Georgia provider and facility changes. Please refer to the NWGA Health Plan Guide for more information. The Choice Fund HSA Plan and the Copay Plan rates and deductibles will increase.

- A specialist visit for the Copay Plan increases to $50.

- Brand-name diabetic medications will have a $50 copay for both plans, excluding test strips. Remember, generic versions are still available at no cost! You’ll generally pay less for generics than for brand name drugs. Talk with your doctor about whether there’s a lower-cost option for your medication.

- The Company’s contributions to employee’s health savings account (HSA) remains the same for all tiers!

- Plus, there are no increases in premiums for any other benefit offerings.

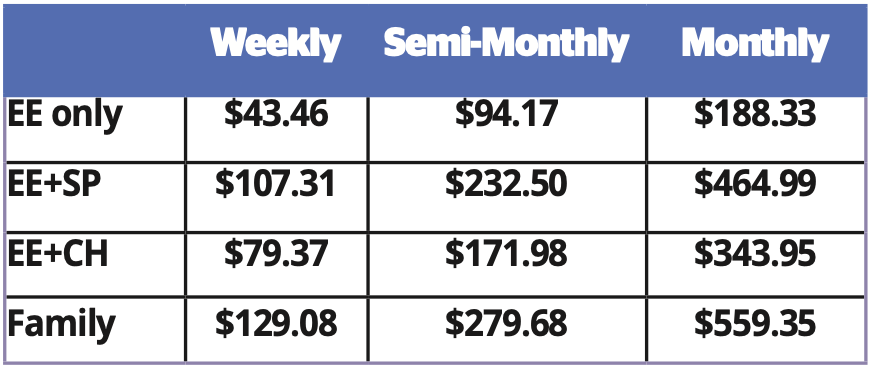

Dental and Vision

Rates for dental and vision stay the same five years in a row!

![]()

Other 2024 Benefit Highlights

Garner-new no cost health plan tool and service

Healthcare Flexible Spending Account

If you are currently enrolled in the healthcare or dependent care flexible spending account and wish to have either again in 2024, you must re-enroll during Open Enrollment and designate your annual election amount. You may elect the healthcare or dependent care FSA even if you do not enroll in a medical plan. Please note, per IRS guidelines, you are not eligible to enroll in the healthcare FSA if you are enrolled in the health savings account (HSA). You may contribute the maximum amount allowed by the IRS.

Your Healthy Life Care Teams

Our Healthy Life Centers continue to expand services to offer innovative ways to connect with all members of the Company health plan. We recently introduced Care Teams—each employee and their dependents have a special team of dedicated professionals ready to help you. Your Healthy Life Care Team may reach out to you and your dependents periodically throughout the year or you can reach out to them via  |

Click the "Benefits 2024" menu at the top or above right for all 2024 plan details. |

![]()

Zip Code Search

Use the ZIP code search feature below to see which plan(s) you're eligible for in 2024.

2024 Medical Rates

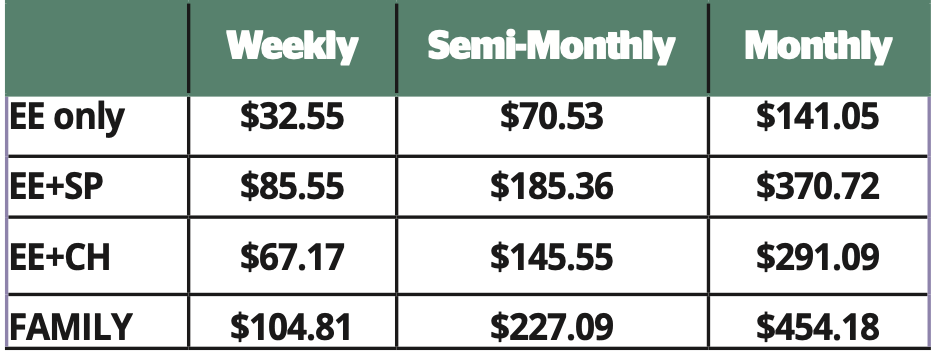

HSA Plan (OAP and Local Plus)

Local Plus Premimum HSA Plan

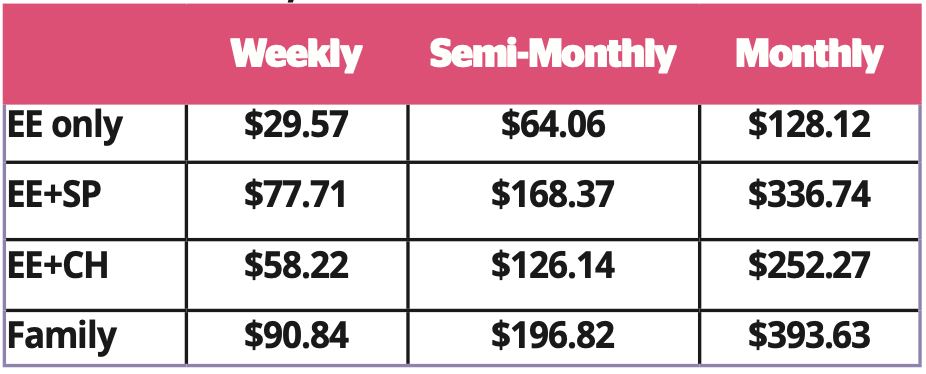

Copay Plan

Medical Plan Surcharges

New enrollees to the company medical plan will be required to complete a biometric screening within 60 days of your benefit effective date to avoid a wellness surcharge. For additional details, visit the Biometrics and Health Coaching page.

Based on results, employees and/or covered spouses may be required to complete face-to-face, telephonic or online health coaching. Employees and covered spouses who choose not to work with a Healthy Life Team Navigator (HLN), do not make contact with their HLN or do not complete biometrics testing, will be charged an additional $28.85 per week or $125 per month as a surcharge on top of your medical plan premium.

If you enroll a spouse in the Company Medical Plan, they will be included in a spousal audit for other medical coverage. If your spouse’s employer offers insurance and you elect to cover him/her on Mohawk’s Medical Plan, you will pay an additional $125 per month in medical contributions.

*New hires and those new to the medical plan as a result of a Qualifying Life Event, please visit the Biometrics and Health Coaching page for details.

![]()

Other Benefits Available to You

As a Mohawk employee, you are eligible for a slate of additional benefits and employee discounts that can help you save money. They include:

|

|

|

|||||

|

|

|

|||||

|

|

|

![]()

Questions?

If you have questions about your benefits, call the Benefits Service Center and speak with a Benefits Specialist at 1-866-481-4922.

- Monday - Thursday from 8 am - 6 pm ET, Friday from 8 am - 5 pm ET.